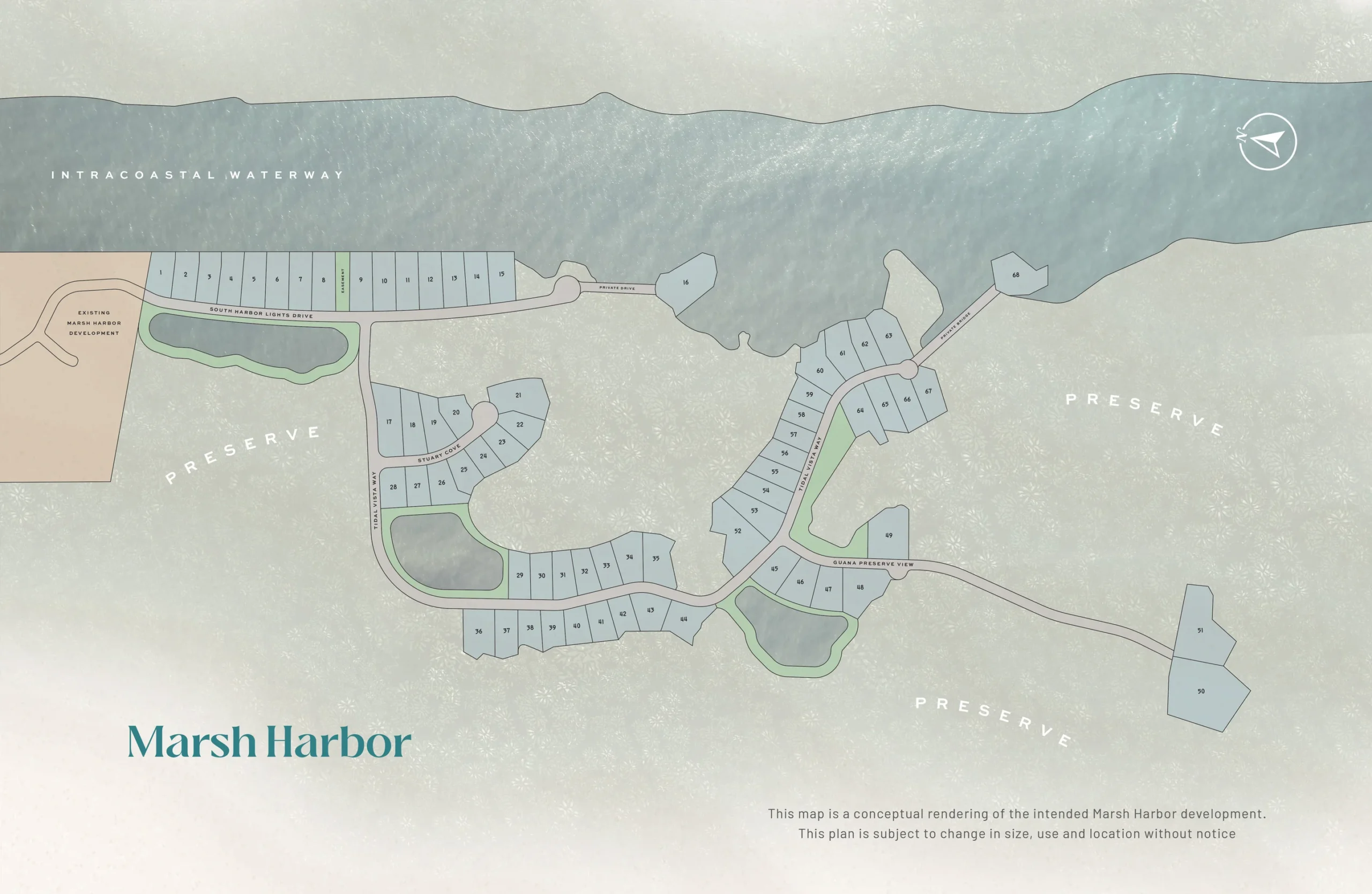

”Island” & Intracoastal homesites have already been platted with Toll Brothers actively selling marsh & preserve view lots.

Marsh Harbor is an existing community of single-family homes on the west side of the Intracoastal Waterway, at the foot of the Palm Valley bridge. In 2025, new homes will come to this quiet, gated community, including some along the Intracoastal waterway.

Toll Brothers Actively Selling 28 Lots

Already, Toll Brothers is marketing and selling 28 lots with marsh & preserve views. The builder touts these as oversized homesites, and is offering 5 home plans, designed for indoor/outdoor living.

Bayou Plan

- 5 bedrooms, 4 1/2 baths, 3-car garage & 3,762 s.f.

- Single-story plan w/dedicated office/den

- Open plan w/spacious covered lanai

Darrington Plan

- 4 or 5 bedrooms, 4 or 5 baths, up to 4 garage spaces & 4,078 s.f.

- 2-story plan w/soaring great room, loft & covered lanai

- Secondary bedroom on 1st floor has en suite bath, ideal for guests

Mclennan Plan

- 4 bedrooms, 3 1/2 baths, 3 garage spaces, 4,263 s.f.

- 2-story plan with spacious primary suite on 2nd floor

- Additional bedroom w/en suite bath up has covered balcony

Williston Plan

- 5 or 6 bedrooms, 4 1/2 baths, 3-4 garage spaces, 4,588 s.f.

- 2-story plan w/3 bedrooms up & 2-story great room & foyer

- Dedicated laundry space at garage entry & abundant storage

Hutchinson Plan

- 5 bedrooms, 4 1/2 baths, 3 garage spaces, 4,691 s.f.

- 2-story plan with primary suite down, 3 bedrooms & workspace up

- Flex room down & large covered lanai

Parc Group Offering Intracoastal & “Island” Homesites

Parc Group, the same company that developed Nocatee and numerous other communities, is behind the expansion of Marsh Harbor. Beginning in 2025, they plan on offering exclusive waterfront lots on the Intracoastal, as well as several “island” homesites offering a unique sense of privacy and exclusivity.

If you’d like more information on these exclusive opportunities in Marsh Harbor, drop us a line below:

Contact Us

"*" indicates required fields

CDD Disclosure ›

CDD Disclosure ›